APRIL FOOLS!!!

You are certainly not going to live forever, and we do hope you will be healthy until it’s time for you to move on to greener pastures… but what if you aren’t indefinitely healthy?

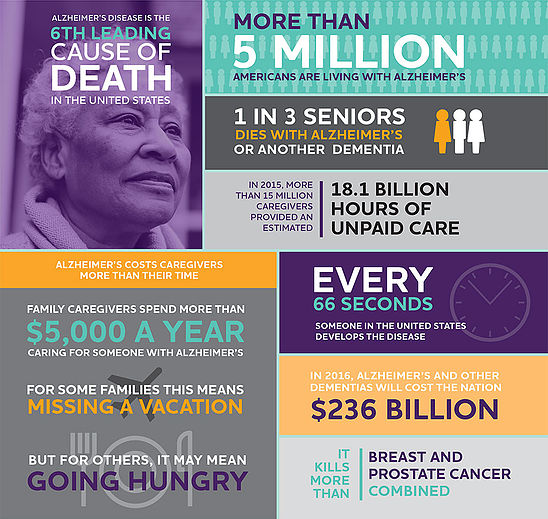

Did you know that 5.1 million Americans may suffer from some form of Dementia, including Alzheimer’s Disease? This number only rises as the population of aging adults rises. According to the U.S. Census Bureau, the number of people age 65 and older will more than double between 2010 and 2050 to 88.5 million or 20 percent of the population. That’s double the chance that you or someone you know will have Alzheimer’s as they get older. Although there is no cure or prevention for the disease, there are ways to deal with the repercussions it will have on our ability to care for ourselves and for our finances.

How can Estate Planning help?

There are two aspects to caring for oneself:

- Decisions about our person

- Decisions about our property

Simply put, decisions about our person deal with things like medical decisions, where we reside, whether we should marry and whom, whether to travel and where, etc. Decisions about our property deal with managing financial accounts, maintenance and/or sale of real property, suing and defending law suits, executing contracts, etc.

Without the proper estate planning documents, the two most important of which are the Durable Power of Attorney and the Designation of Healthcare Surrogate, a family member or a friend must open two cases with the court: the first requesting the court determine you to be incapacitated, and the second requesting the court appoint an individual or company to be your guardian if you are in fact incapacitated. Part of the process of determining your incapacity is to strip you of rights that the Court believes you are no longer capable of exercising and delegating those rights to the individual or company the Court believes is in your best interest to be your guardian.

Although our court system does an okay job of protecting wards of the state, it does not know you personally. It does not know what is normal for you and what isn’t. But I bet your niece knows. Or perhaps your sister or brother. With the documents mentioned above, you can name an individual you TRUST to make the appropriate decisions for you in the event of your incapacity, you can empower them to make these decisions, and thus, you can avoid the necessity of a guardianship which will cost thousands upon thousands of dollars in attorneys’ fees and costs to be paid from your assets.

Don’t wait until it’s too late to prepare these documents. Seek the advice of counsel while you have a clear mind and are able to make the decisions necessary to execute them.

Irama Valdes, P.A. offers a free consultation for all estate planning clients. Schedule a meeting with us by contacting our office at (786) 671-7829. We are happy to go into more detail and formulate a plan that works best for you.

(C)

(C)